- QUICKEN MINT PERSONAL CAPITAL BLOG REVIEW 2017 HOW TO

- QUICKEN MINT PERSONAL CAPITAL BLOG REVIEW 2017 SOFTWARE

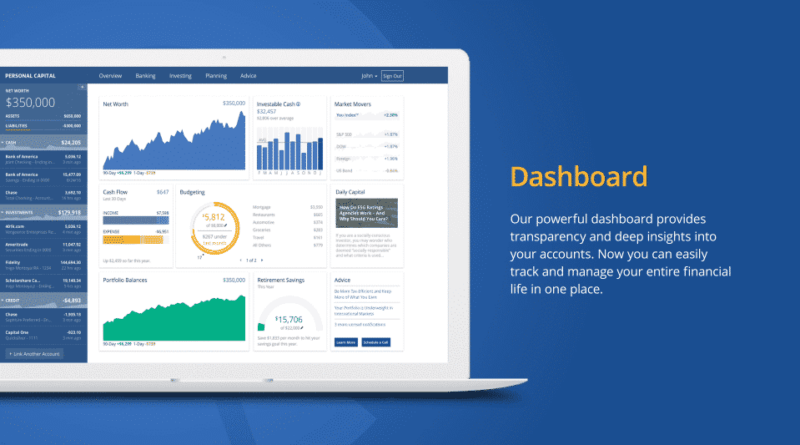

A holistic view of consumers’ money to make informed decisions.Financial advice that is within their customer’s best interests.Personal Capital holds itself to high standards according to their company philosophy: They currently have over 1 million registered users that are actively managing $2 billion in assets. Personal Capital is a financial planning tool that aims to make online investment management more accessible to consumers, more honest, and more transparent. Personal Capital wants to “build a better money management experience for consumers” by blending financial advice with state-of-the-art technology.

It should also offer various reporting functions so you can see your money in many different ways.

QUICKEN MINT PERSONAL CAPITAL BLOG REVIEW 2017 SOFTWARE

Additionally, you’ll want to make sure that the online financial planning tool offers authentication measures besides just a username and password.Īdditionally, make sure that the financial planning software you select offers compatibility on all the devices where you will want to use it, such as your smartphone or tablet. Read up on the security policies of the site you choose and ensure that there are backup measures in place in the event of a breach. You’ll also want to assess the security features and accessibility of the software.

For example, if you hold multiple investments across many different channels, you will want to make sure the software you select offers the ability to import information on all these investments into one place. Make sure the features offered will encompass all your various needs. The site that works best for one person may not be the best choice for another, so always go through a free trial of a program before you commit.Īs you will see, not all financial planning tools offer the same features. Though the below reviews will give you a good overview of the pros and cons of different financial planning software, it’s important to do your own analysis to determine which service works best for your needs.

QUICKEN MINT PERSONAL CAPITAL BLOG REVIEW 2017 HOW TO

How to Choose the Financial Planning Tools That Are Right for You

0 kommentar(er)

0 kommentar(er)